Beyond the Map: Unleash the Potential of POI Data

Point of interest (POI) data is the invisible backbone behind business decisions across numerous industries.

Behind every mapped location lies rich, actionable information, from business names and categories to operating hours and contact information. This data turns static coordinates into strategic assets that drive revenue and competitive advantage.

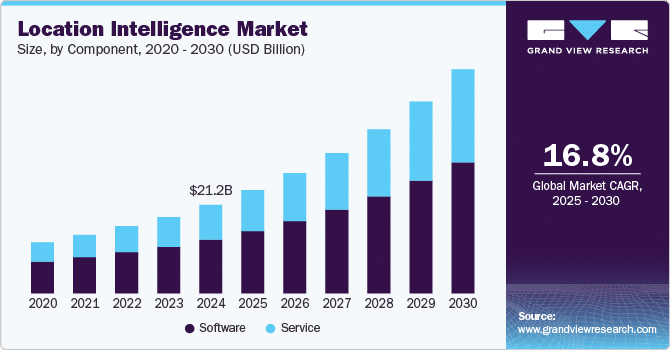

According to Grand View Research, the location intelligence market is worth $24.7 billion in 2025, with POI database utilization driving significant portions of this growth.

As businesses across industries realize the competitive advantage of using detailed location information, understanding how to choose and use POI data is critical.

In this article, we will explore what makes a good POI database, how different industries use this data to get results, best practices to maximize POI data value, and why dataplor is a trusted player in the global location intelligence market.

Choosing a Powerful POI Database: Key Considerations

When evaluating POI database options, decision makers need to look beyond the surface level to assess several key factors that determine long-term value and effectiveness.

Data Accuracy and Completeness

The foundation of any good POI database is accuracy.

Without reliable information, even the most sophisticated analysis will give wrong results. High-quality POI data providers have rigorous verification processes to eliminate duplicates and errors. This involves both automated systems and human verification

For example, dataplor uses a proprietary combination of AI-powered tools and in-market experts who validate information with local knowledge and cultural context.

Businesses open and close daily, street addresses change, and phone numbers are reassigned, making data freshness a key factor. The most valuable POI databases are updated continuously, reflecting the constant changes in the physical world.

When evaluating database options, ask about verification methods and update frequency to ensure you’re working with current data.

Data Coverage

For organizations operating across multiple regions or countries, global coverage is non-negotiable. However, international POI data has its own challenges due to varying address formats, language variations, and regional categorization systems.

Top POI database providers offer coverage across hundreds of countries and territories.

dataplor, for example, has POI data across more than 250 countries and territories, with expertise in navigating international address formats and language variations.

This global perspective allows businesses to have consistency in their location analysis regardless of geographical boundaries.

Data Structure and Format

The structure of POI data matters a lot when it comes to usability and integration.

Many organizations face challenges with POI datasets that have the same information in different fields or different categorization systems across regions. This inconsistency makes it difficult to analyze data at scale or integrate with existing systems.

A well-structured database should have a consistent schema, ensuring business names, addresses, and categories follow the same format across all locations and regions.

For instance, dataplor’s consistent schema ensures that all POI data has the same structure globally, eliminating the complexities of data cleaning and normalization and enabling businesses to scale their analysis across international markets with ease.

Data Enrichment Capabilities

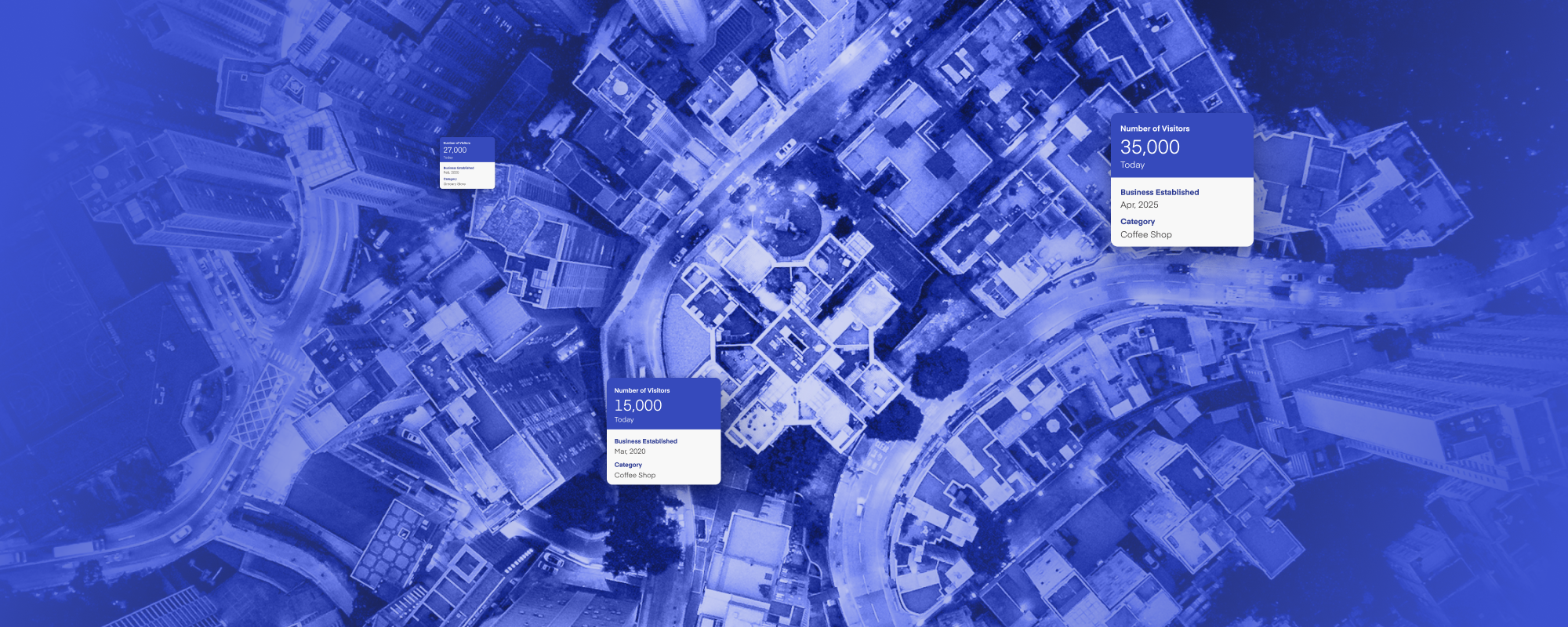

Basic location information is a starting point, but enriched POI data offers much more.

Enhanced datasets may include:

- Detailed categorization hierarchies

- Website URLs and social media links

- Operational status (temporarily closed, permanently closed, etc.)

- Foot traffic and visitor counts

- User-generated content and reviews

These enrichment factors turn basic location data into context-rich information that powers more advanced analysis and applications for businesses.

How Businesses are Leveraging POI Data

Across industries, forward-thinking companies use points of interest data to drive strategic initiatives and get ahead of the competition.

Here’s how different sectors are using points of interest information to identify trends and make informed decisions.

Retail and Consumer Packaged Goods

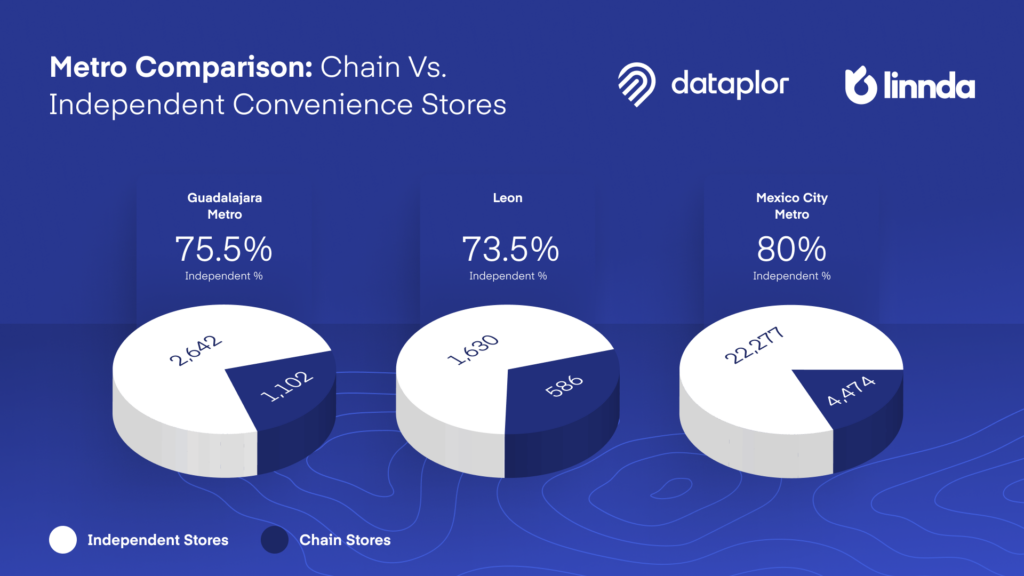

Retail giants and CPG companies use POI data to inform decisions on market entry, competitive positioning, and distribution strategies.

For example, a coffee chain expanding into Vietnam would look at a POI database to know the competitor density, proximity to public transportation, and nearby businesses that would drive foot traffic.

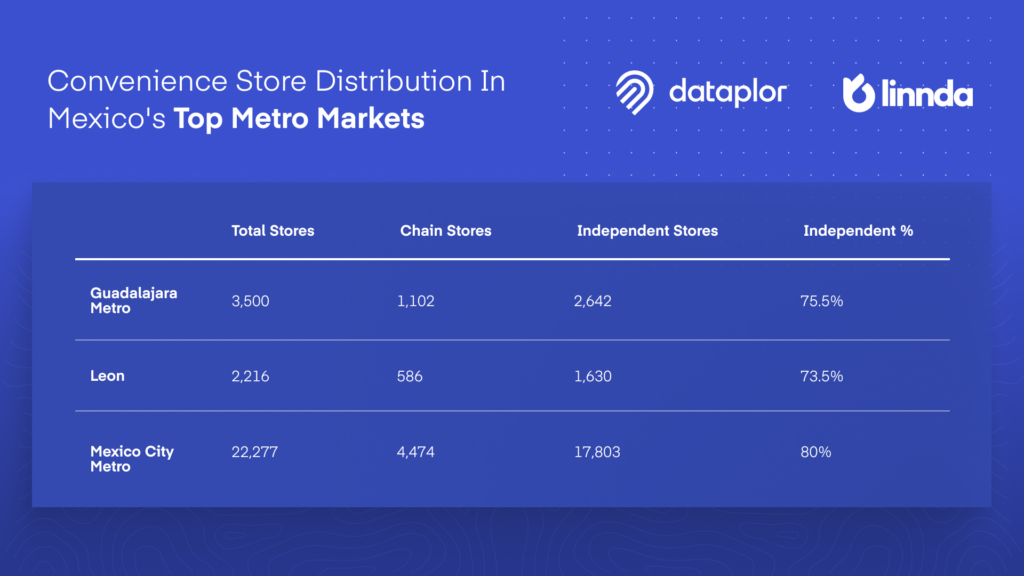

Similarly, CPG brands use POI data to optimize product distribution and marketing strategies.

By analyzing the physical location of grocery stores, shopping malls, and retail outlets, CPG companies can identify high-potential areas for new product launches or promotional campaigns.

For example, by combining POI data with information about the types of retailers in a specific area, CPG brands can prioritize distribution to locations that align with their target audience and consumer behavior patterns.

Real Estate and Investment Analysis

Real estate investors use POI databases to find emerging market opportunities and evaluate property potential.

By tracking geospatial data on new business establishments, store openings, and nearby places like fitness centers or high-end restaurants, investors can identify growing areas before market prices reflect the area’s potential.

Furthermore, hedge funds and investment firms analyze patterns of business establishment, longevity, and closure rates from POI data to assess the health of a specific area. This comprehensive data intelligence informs investment strategies with actionable insights across real estate, retail, and other sectors.

Logistics and Supply Chain

POI databases are essential for logistics companies, delivery services, and supply chain operators, enabling efficient route optimization and operational planning.

Accurate location data for warehouses, distribution centers, retail outlets, and surrounding areas facilitates more efficient delivery routing and reduces transportation costs.

When combined with traffic data and mobility information, POI data empowers logistics operators to predict delivery times more accurately and adapt routes to real-world conditions.

Navigation and Mapping Services

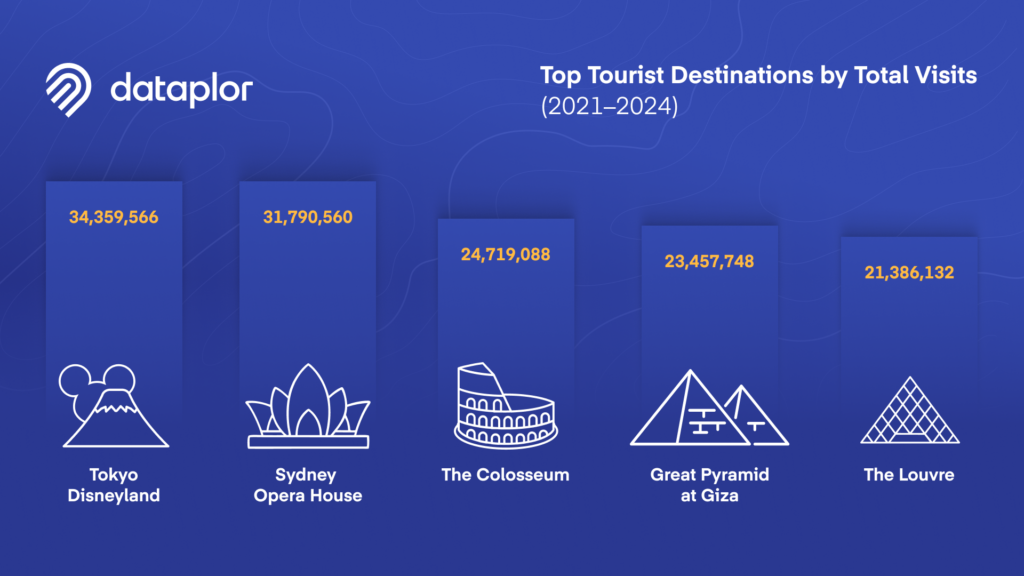

Digital mapping and navigation systems rely on POI databases to inform users about nearby places. From restaurants and historical sites to emergency services and parking lots, these applications need accurate and up-to-date information about millions of locations to deliver proper guidance.

While consumer-facing mapping apps show limited information, professional POI database services provide the underlying data organizations need to create customized mapping solutions that meet their business goals.

Maximizing the Value of POI Data: Tips and Best Practices

To unlock the full potential of POI data, consider these important guidelines.

Data Analysis and Visualization

Raw POI data is most valuable when transformed into visualizations that show patterns and relationships. Geographic information systems (GIS) and specialized data visualization tools allow analysts to map POI data against other variables like demographic data, traffic patterns, or sales data.

These visualizations reveal trends and correlations often hidden in spreadsheets or databases. For example, retailers can map competitor locations against demographic data to find underserved markets with ideal customer profiles.

Data Integration

POI data on its own has value, but when integrated with other datasets, it multiplies that value. By combining POI database data with internal sales data, customer records, or third-party market research, you get a more complete view of your operating environment.

This allows for more advanced analysis, such as correlating store performance with nearby businesses or knowing how proximity to specific points of interest affects consumer preferences and buying behavior.

Data Privacy and Security

As location data becomes more valuable, responsible data stewardship becomes more critical.

Organizations must ensure their POI data usage complies with relevant privacy regulations and security standards, especially when combining location data with other datasets.

Reputable POI data providers prioritize privacy-compliant data collection methods and have transparent policies regarding data sourcing and usage restrictions.

dataplor: Your Trusted Source for POI Data

When looking for POI database providers, organizations increasingly turn to dataplor for our global coverage, data accuracy, and consistent structure.

Unlike competitors who may excel in specific regions or have different data schemas across markets, dataplor provides uniformly structured, accurate data across more than 250 countries and territories.

dataplor’s approach combines technology and human expertise, using AI-powered tools to collect and flag potential errors while in-market experts provide cultural context and language-specific verification.

This dual approach promises scale and accuracy, delivering POI data that organizations can rely on for critical business decisions.

Our commitment to data hygiene sets us apart from open-source alternatives or providers with less rigorous verification processes. With hundreds of people working full-time to verify accuracy, dataplor creates POI databases that meet the standards of the world’s most demanding enterprise users.

Unlike restrictive licensing models that limit data usage to short periods or specific applications, dataplor offers flexible licensing terms that allow clients to own their data outright. This eliminates recurring licensing fees and gives businesses more freedom to deploy location intelligence across the organization.

POI Data: A Catalyst for Innovation and Growth

From retail expansion and supply chain optimization to competitor analysis and strategy, access to new POI data gives you the location context to make better business decisions.

Whether you have your own database or are looking for existing ones from trusted vendors for more detailed information, the winning organizations know that POI database quality impacts the quality of their analysis and planning.

By choosing comprehensive, accurate, and consistently structured data sources, they build a stronger foundation for location-based intelligence.

dataplor’s global POI database is the result of years of verification processes, international expertise, and delivering high quality location data to enterprise clients.

dataplor’s solutions offer a powerful way to unlock the full potential of location intelligence for your business. Get in touch with us to find out how dataplor’s POI database solutions can help your location intelligence today!