European Trends in Tourism (and Tourism-Adjacent) Businesses

After several dispiriting years of pandemic-related travel restrictions, tourism in Europe is back in full swing and booming more than ever this summer. With the revival of this important economic sector, local businesses in tourism-focused industries such as dining and hotels are experiencing significant growth. The European Travel Commission estimates that tourists will contribute a record €800 billion to Europe’s economy this year—a 37 percent increase over pre-pandemic levels.

While the surge in visitors is not without controversy for the countries hosting them, the influx of tourists is undeniably revitalizing the tourism sector in ever-popular destinations such as London, Paris, and Rome, as well as emerging hotspots in southern and eastern Europe.

This raises the question: what does the economic boom look like on the ground? By analyzing our Point-of-Interest (POI) data, we’ve uncovered trends in business growth across the region, particularly in Paris. The city is currently welcoming athletes, their families, and fans from around the world for this year’s Summer Olympic Games.

Regional Trends To Watch

The highest growth percentages in the total number of business locations since 2023 paint an interesting and dynamic picture of recovery. Which regions ended up at the top of the lists? For our analysis, we categorized European nations as follows:

- Northern Europe: Norway, Sweden, Denmark, Finland, Iceland, United Kingdom, Ireland

- Western Europe: Austria, Belgium, France, Germany, Liechtenstein, Luxembourg, Monaco, Netherlands, Switzerland

- Southern Europe: Andorra, Italy, Malta, Portugal, San Marino, Spain, Vatican City

- Eastern Europe: Belarus, Bulgaria, Czech Republic, Hungary, Moldova, Poland, Slovakia, Ukraine

- Southeastern Europe: Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Greece, Kosovo, Montenegro, North Macedonia, Romania, Serbia, Slovenia

Across Europe, three regions lead in the growth of new restaurant and bar openings: Western Europe, Eastern Europe, and Southeastern Europe. This surge likely reflects tourists’ desire for diverse culinary experiences while traveling abroad. These same three regions also top the list for new bar openings, highlighting their vibrant nightlife and social scenes, which attract both locals and tourists.

In the travel sector, including hotels and tourism agencies, the most significant growth has occurred in Western Europe, Southern Europe, and Southeastern Europe, demonstrating a strong rebound in the hospitality industry. The influx of tourists to these regions has also driven the highest growth in transportation, underscoring the need for efficient and expanded transit options for visitors.

As for shopping, new retail businesses have flourished in Western Europe, Southeastern Europe, and Southern Europe, driven by increased tourist spending. The entertainment and recreation sector has experienced the highest growth in Western Europe, Southern Europe, and the Nordics, reflecting a higher demand for a variety of leisure activities in those areas.

Hot-Off-the-Press Country Trends

What does the data tell us about the tourism recovery landscape at the country level and its impact on local economies? Let’s examine the growth of tourism-focused businesses across various European nations.

If you’re curious about the latest trends in the European dining and bar scenes, Serbia, Italy, and the Netherlands are leading in new restaurant openings, followed closely by Ukraine, Germany, and France. Serbia, Italy, and the Netherlands are at the top for new bar openings, with Belgium, Ukraine, and France seeing significant growth in places to enjoy a drink with friends and locals.

As expected, the enormously popular tourist destinations like Italy, France, and Greece are at the forefront of travel-related business growth. Italy and Serbia lead in the transportation sector’s growth, followed by Belgium, the Netherlands, and Greece.

Retail business growth has been most notable in Serbia, the Netherlands, and Italy, followed by France and Germany, where tourists’ shopping habits are undeniably contributing to the sector’s expansion. Finland, the Netherlands, and France lead in entertainment and recreation business growth, with Italy and Serbia also seeing increases. These countries, already popular with tourists, are enhancing their appeal by offering a wide range of recreational activities to tourists.

Where to Find the Most Bars and Restaurants

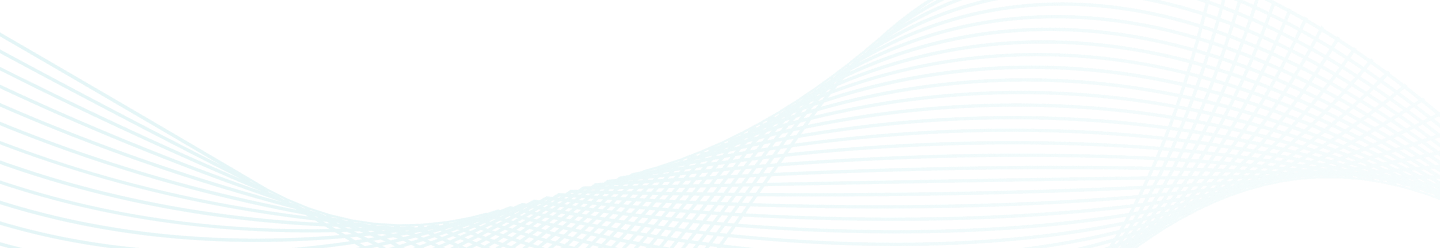

For travelers seeking the most diverse and vibrant bar scenes in the E.U., Italy, Spain, and France are top destinations for raising a glass, followed closely by the United Kingdom and Germany. If dining out is a top priority while on vacation, Germany, France, and Italy offer the most restaurant options, while Spain and the United Kingdom are next in offering visitors a rich array of culinary options.

Spotlight on Paris

Paris is in full hosting mode for the 2024 Summer Olympics, which is already having a significant impact on tourism-related sectors.

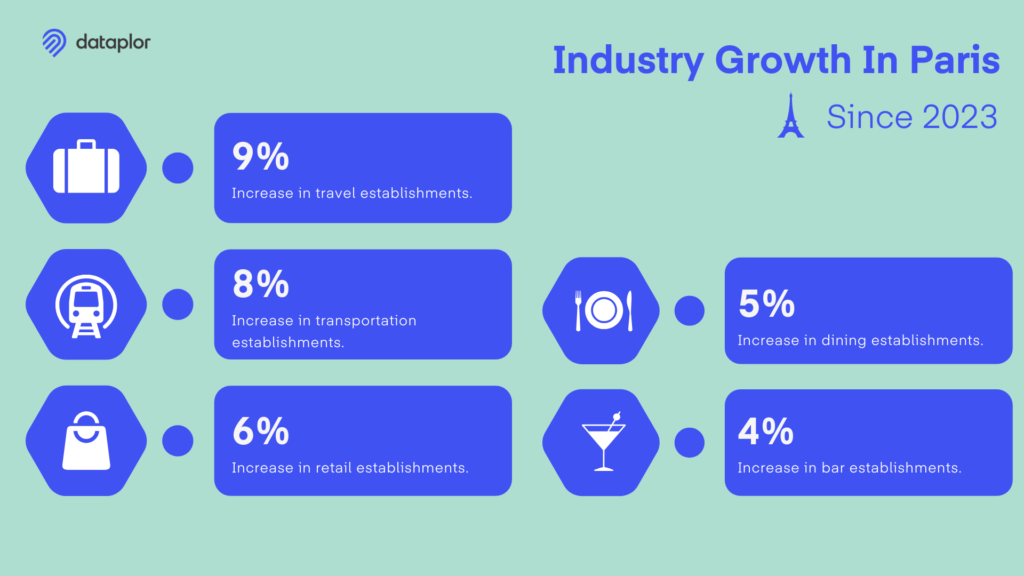

Out of all the travel POIs, which pinpoint businesses such as lodging and travel agencies, 9 percent have opened since 2023, marking the highest number of recent openings in any category. The transportation sector has also seen substantial growth, with 7 percent of new openings in relation to other categories, reflecting preparations for the influx of visitors for the Games. Dining establishments have seen 5 percent of openings relative to other areas, and the number of bars has accounted for 4 percent of new openings, giving visitors more options for meals, aperitifs, or late-night celebrations of Olympic victories. Finally, Paris’s retail footprint accounted for 6 percent of openings, as the city strives to meet tourists’ insatiable appetite for shopping in the City of Light.

A Glimpse into the Future

As the data clearly shows, the resurgence of European travel is fueling significant growth across multiple tourism-related business sectors. The increase in business locations, particularly in dining, bars, travel, transportation, retail, and entertainment and recreation, highlights these industries’ ability to bounce back and thrive after extremely challenging times.

Paris, with its preparations for the Summer Olympics now coming to fruition, provides an excellent example of how major events like the Games can accelerate growth in tourism-adjacent businesses. These trends not only reflect the current state of the tourism industry in Europe, but also indicate a future where travel and tourism continue to play a vital role in Europe’s economic landscape. As the tourism sector evolves, paying attention to these trends will become increasingly important, providing crucial insights into where people are headed and how businesses can adapt to meet their needs.

You might also like:

How dataplor Differs from Other Location Data Companies How a multifaceted approach to AI drives dataplor’s business A Buyers’ Guide to POI Data Why is International Location Data So Inaccurate? Unlocking Global Competitive Intelligence with Location Data 3 Ways International Point of Interest Data Can Help Grow Your BusinessSubscribe to our blog and receive great content just like this delivered straight to your inbox.