Geofencing Data: A Strategic Asset for Modern Business

Have you ever walked into a store and received a perfectly timed discount notification on your phone? Or perhaps wondered how businesses seem to know exactly when you’re near their locations?

The intersection of the physical and digital realms has created powerful new ways for businesses to connect with consumers, but what’s really happening behind the scenes?

Today’s most innovative enterprises are quietly revolutionizing how they engage customers by tapping into one of the most underutilized data assets available: the precise geographic locations where people spend their time.

As mobile devices become extensions of ourselves, the data generated from our movements creates unprecedented opportunities for businesses to understand and respond to customer behavior in real-time.

At the core of this revolution is geofencing data. This is any information generated when users cross virtual boundaries established around physical locations. This powerful dataset is transforming how businesses make strategic decisions across industries, from retail to real estate, logistics to finance.

In this article, we will review what geofencing data is, how it works, and most importantly, how forward-thinking organizations like yours can partner with dataplor and use it to gain a competitive advantage in an increasingly location-aware marketplace.

Geofencing Data: What It Is and How It Works

Think of geofencing as setting digital tripwires around real-world places such as your storefront, a rival’s location, or even a busy commercial hub. When someone enters or exits these zones, it triggers a flow of actionable data. That’s the core power of geofencing technology.

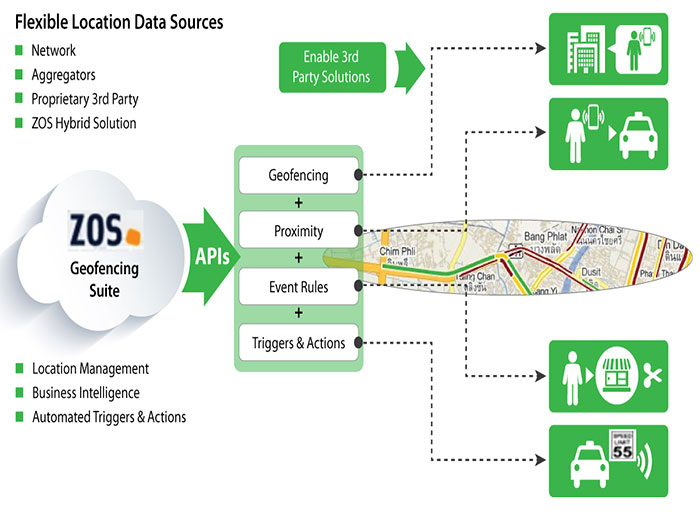

Geofencing data is created when a mobile device’s location enters or exits a predefined virtual boundary established around a physical location. These virtual fences typically rely on Global Positioning System (GPS) technology, cellular data networks, Wi-Fi signals, or radio frequency identification (RFID) to detect when a device crosses the established perimeter.

The resulting dataset doesn’t identify specific individuals but instead reveals patterns like:

- How many devices entered a location

- How long they stayed

- What time of day saw peak activity

- How these patterns change over time

For example, a retail chain might establish geofences around all store locations to understand foot traffic patterns before and after a major marketing campaign.

In fact, businesses using geofencing see a doubled engagement rate compared to standard mobile targeting methods.

What makes geofencing work effectively is its ability to trigger actions based on location context. When a device enters or exits a virtual boundary, geofencing software can automatically collect anonymized data about that movement, providing businesses with valuable insights about location-based behavior while maintaining user privacy.

Strategic Applications of Geofencing Data Across Industries

Wondering how geofencing data makes an impact in different industries? Here’s what you need to know.

Retail and Marketing

The retail sector has emerged as one of the primary beneficiaries of geofencing technology. By understanding how customers move around and between physical locations, retailers can refine their targeted marketing strategy and optimize operations.

Location-based marketing becomes dramatically more effective when informed by geofencing data. Rather than blanketing an entire region with generic advertisements, businesses can deliver targeted advertising and messaging to mobile users based on their geographical location and specific movement patterns.

For instance, a coffee shop might analyze patterns of devices that regularly visit competitor locations, then tailor specific offers to those potential customers.

Source: Salesforce

In-app and push notifications triggered by geofencing capabilities allow brands to engage customers at the most receptive moments, when they’re physically near a retail store or have just entered a shopping district. 80% of consumers want location-based alerts and are willing to share location data in exchange for relevant offers.

Sophisticated retailers are now using geofencing statistics to understand the relationship between external events and store visits, measuring how weather patterns, local sports events, or even traffic disruptions impact customer flow.

Real Estate and Urban Planning

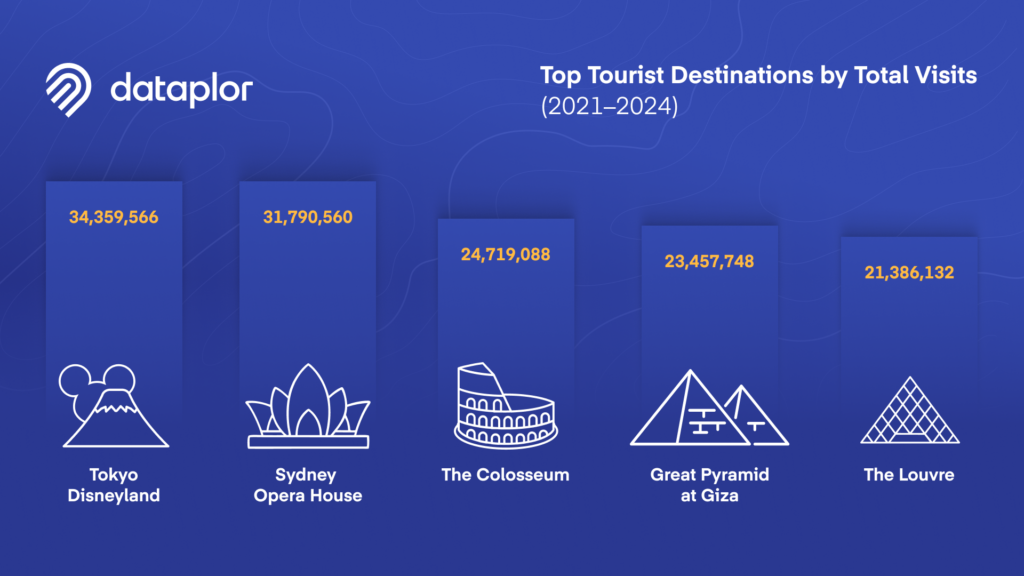

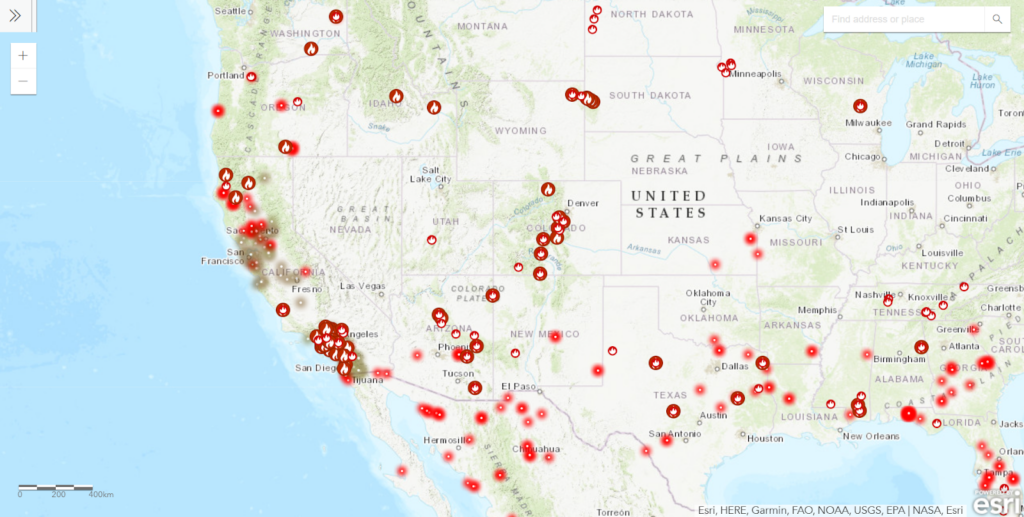

For real estate developers and urban planners, understanding how the local population moves through space is invaluable. Geofencing data provides insights into which areas receive high foot traffic, when people visit different districts, and how long they typically stay.

By establishing virtual boundaries around different neighborhoods, developers can quantify movement patterns and identify emerging hotspots before they become obvious to competitors. This gives early movers a significant advantage in site selection and property acquisition.

Real estate investors are increasingly integrating geofencing data into their analysis frameworks, using foot traffic as a leading indicator of area desirability and economic vitality. For example, a neighborhood showing increasing dwell time and visit frequency often signals rising property values.

Logistics and Operations

The logistics sector has embraced geofencing solutions for both fleet management and asset management. By defining virtual boundaries around warehouses, distribution centers, and delivery zones, companies gain unprecedented visibility into their operations.

Source: Happiest Minds

When a delivery vehicle enters or exits a designated area, geofencing software can automatically log arrival and departure times, eliminating manual check-ins and improving data collection accuracy. This creates a wealth of information for optimizing routes and schedules.

For CPG companies, understanding how products move through distribution networks and into retail environments is critical. Geofencing relies on location tracking to provide visibility into this journey, helping brands ensure optimal product placement and availability.

Beyond traditional logistics, drone management has emerged as a cutting-edge application of geofencing technology. By establishing no-fly zones and operational boundaries, drone operators can automate compliance with regulations and optimize flight paths.

Finance and Risk Management

Financial institutions are harnessing geofencing capabilities to enhance security and deliver more personalized location services. When customers enter branch locations, sophisticated systems can analyze traffic patterns to optimize staffing and service delivery.

Risk assessment benefits from location data by identifying unusual patterns that might indicate fraud. For example, if a customer’s device enters or exits locations in a pattern inconsistent with their established behavior, additional verification might be triggered.

Investment firms analyze geofencing data to evaluate retail performance, feeding location-based insights into their valuation models. Understanding customer engagement at specific locations provides a competitive advantage when making investment decisions.

Key Considerations for Leveraging Geofencing Data

Before you begin to use geofencing data, you need to keep these key factors in mind.

Defining Clear Objectives

Before implementing geofencing as part of your business strategy, clearly articulate what you hope to achieve.

- Are you looking to enhance customer engagement?

- Improve operational efficiency?

- Gain competitive intelligence?

The specific goals will determine which aspects of geofencing data are most valuable to your organization.

For location-based triggers to deliver value, they must connect to specific business outcomes. Random data collection without a clear purpose rarely yields actionable insights.

Data Accuracy and Reliability

The effectiveness of any geofencing campaign depends entirely on the accuracy of the underlying data. Location accuracy can vary significantly based on the technology used (GPS vs. cellular geofencing) and environmental factors.

High-quality geofencing data requires precise latitude and longitude coordinates for each location, consistent monitoring of when a device enters or exits boundaries, and reliable processing of this information.

Working with experienced providers like dataplor who specialize in location-based services is essential for meaningful results.

Privacy and Compliance

Consumer privacy must remain paramount when working with location data. Ensure all geofencing work complies with relevant regulations like GDPR and CCPA, focusing on anonymized, aggregated data rather than tracking specific individuals.

The most sustainable approach is to focus on patterns and trends rather than individual user behavior. This not only respects privacy but often yields more strategically valuable insights anyway.

Integration with Other Data Sources

Geofencing data becomes exponentially more valuable when combined with other business intelligence. Integrating location-based insights with customer profiles, transaction histories, and external factors like weather or local events creates a comprehensive understanding of the factors influencing customer decisions.

The messaging effectiveness of location-based marketing improves dramatically when informed by a holistic view of customer context and preferences.

The Synergistic Power of Geofencing Data and POI Data

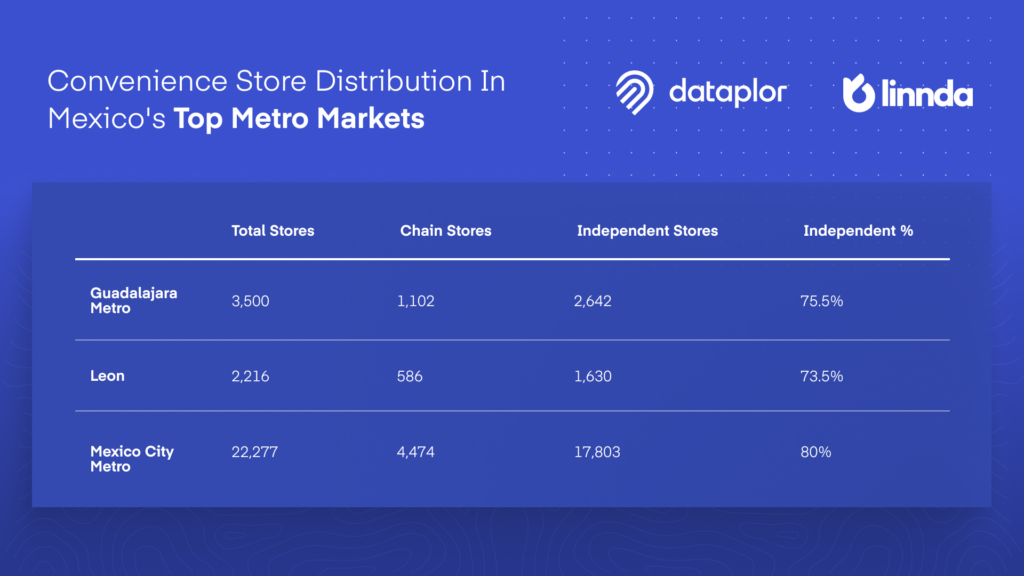

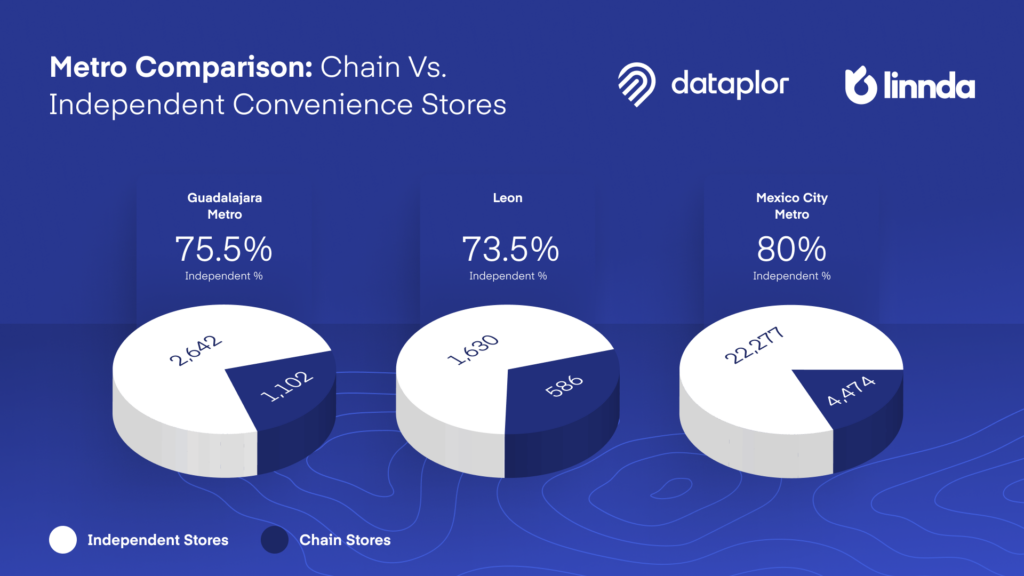

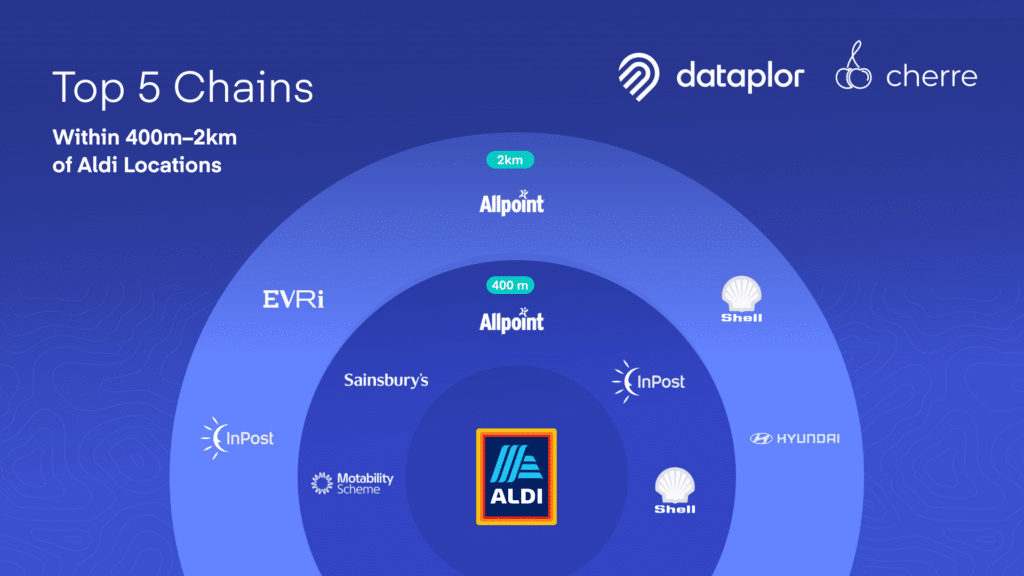

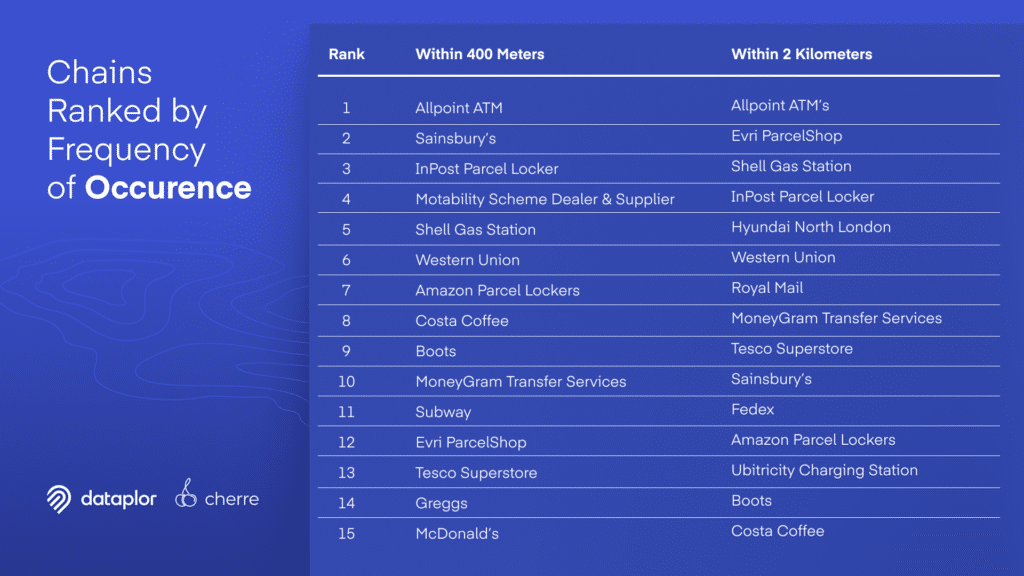

While geofencing technology provides information about when and how many people visit locations, Point of Interest (POI) data tells you precisely what exists at each location. When combined, these datasets create an unparalleled view of the relationship between places and people.

Consider these scenarios:

- A quick-service restaurant chain planning expansion might use POI data to reveal competitor density in various neighborhoods, while geofencing data shows actual foot traffic to those locations. Together, they paint a complete picture of market opportunity.

- For retail businesses, understanding the correlation between specific store attributes (identified through POI data) and customer visits (measured through geofencing) enables more strategic decision-making about store design, merchandising, and marketing efforts.

- Mobile apps that leverage both datasets can deliver highly personalized experiences, sending trigger notifications that are contextually relevant to both the user’s location and the specific characteristics of nearby businesses.

- Media companies can optimize targeted advertisements by understanding both where audiences spend time and what specific businesses or amenities exist in those areas. This allows for more relevant social media ads and mobile ads that connect with consumers at precisely the right moment.

Harness Location Intelligence for Strategic Advantage

The businesses gaining the greatest advantage from geofencing data are those that view it as a long-term strategic asset and a fundamental source of insight that informs decision-making across the organization.

By decoding how people move through the physical world, companies can bridge the online/offline divide and deliver customer experiences that feel seamless, timely, and relevant. Active geofences don’t just track—they reveal patterns, unlock efficiencies, and spark innovation.

As location-based technology becomes more advanced, the winners will be those who build real fluency in geospatial data—collecting it with precision, analyzing it with intent, and acting on it with clarity.

Want to turn location data into a strategic advantage?

Reach out to dataplor today to explore our global, privacy-compliant geofencing and POI solutions. We’ll help you unlock powerful insights and stay ahead in an increasingly location-aware world.