Sharing Insights, Tracking Industry Shifts, and Mastering Places Data: Your Comprehensive Guide

Nov 17, 2025

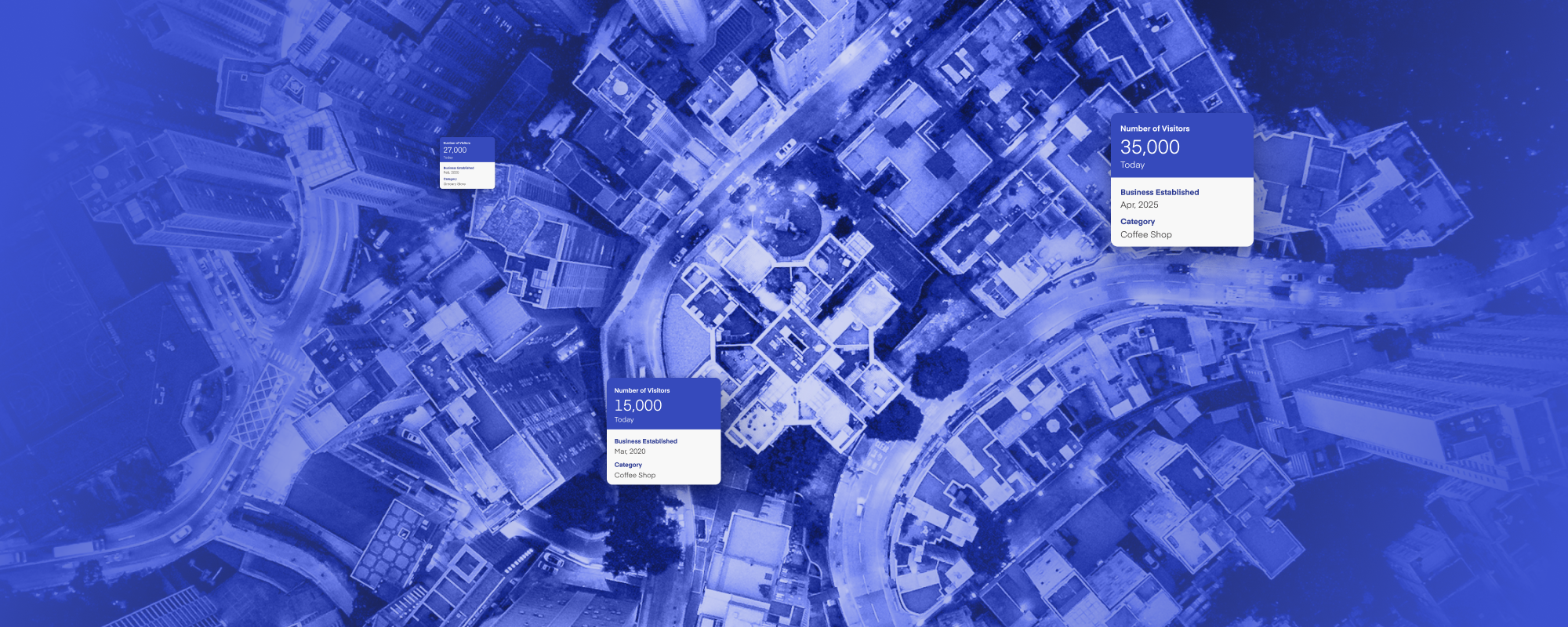

Connecting Clicks to Footsteps: A Retailer’s Guide to Store Visit Attribution

In this article we share how store visit attribution bridges online marketing to physical store traffic, helping retailers optimize ad spend and enhance customer journey tracking.

Continue Reading