Comprehensive Location Intelligence Across the Globe

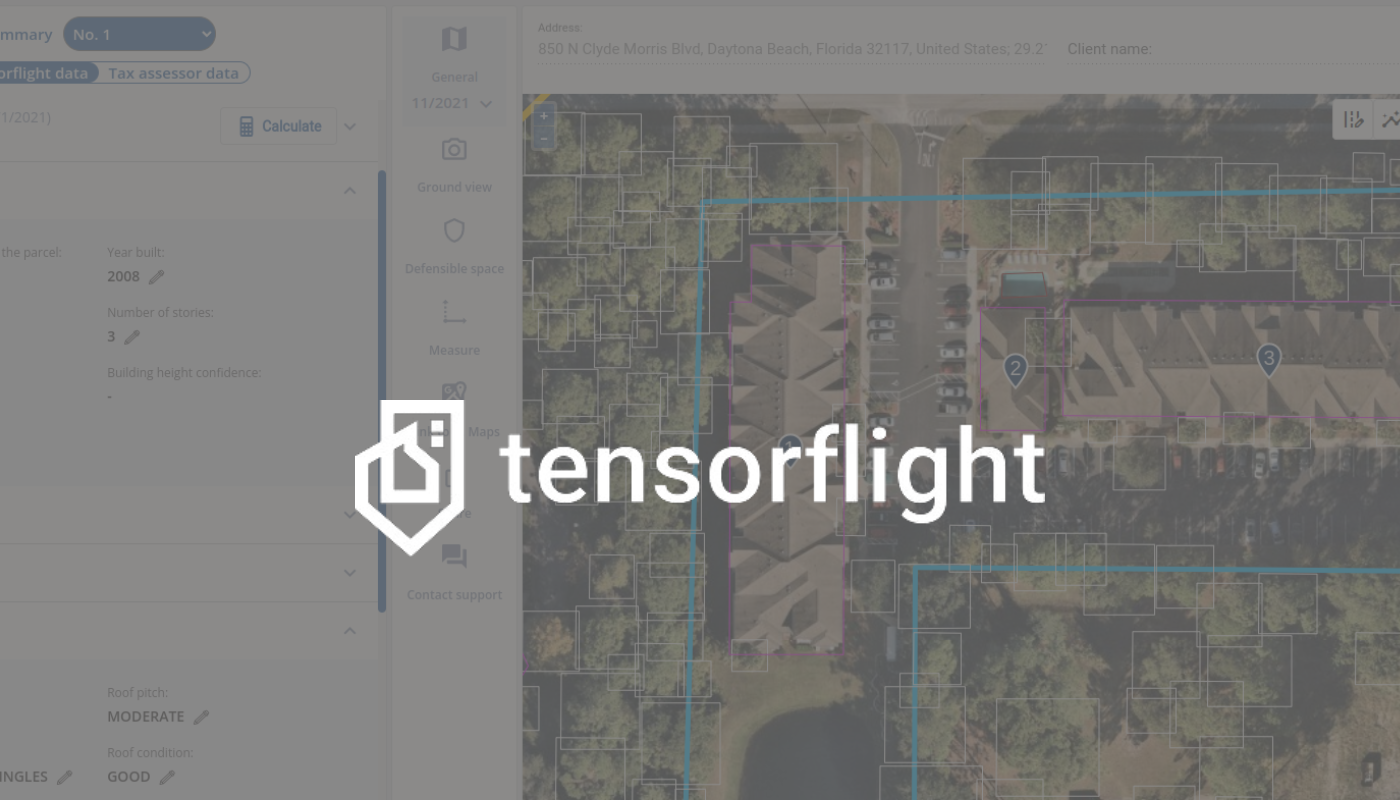

How Tensorflight Revolutionized Property Insurance with dataplor

Tensorflight, a cutting-edge technology company specializing in property analytics for the insurance sector, embarked on a transformative journey to enhance the quality and accuracy of data. Their mission was to empower property insurance companies with the tools to refine their insurance targeting and associated premiums. This case study explores why Tensorflight chose dataplor over other providers, the problems they sought to solve, and the remarkable accomplishments they’ve achieved through this partnership. Additionally, we delve into their future plans for innovation with dataplor.

Why dataplor?

Tensorflight’s rigorous assessment process involved evaluating multiple Points of Interest (POI) providers, all offering places data. They focused on critical factors like coverage breadth, address accuracy, and alignment with insurance-specific attributes. dataplor emerged as the standout choice. Although confidentiality commitments prevent Tensorflight from naming other providers, they assessed over five options, with dataplor distinguishing itself as the prime choice.

The Problem to Solve

Tensorflight sought to enhance the quality and accuracy of data for property insurance companies. Their objective was to enable insurers to determine which buildings were covered by policies, provide detailed attributes such as Building Occupancy Type and Tenant Type, and estimate building replacement costs accurately. They also aimed to merge dataplor’s data with visual and other datasets to optimize classification.

Internal Data Utilization

Tensorflight integrated dataplor’s data extensively into their internal operations. This data resides in their internal data warehouse, serving as a vital resource for analytics and reporting. It fuels proprietary models, including geocoding, building feature identification, replacement cost estimation, and survivability score computation.

Achievements with dataplor Data

Tensorflight’s collaboration with dataplor yielded substantial improvements across various metrics. They observed increased geocoding accuracy, enhanced precision in building replacement cost estimations, and improved accuracy in determining building occupancy types. The refined assessments related to multi-tenant attributes and tenant attributes have proven invaluable to their insurance clientele.

Future Innovations with dataplor

Tensorflight’s future plans for innovation revolve around extensive integration of dataplor’s insights. They are developing new attributes, such as building survivability scores, which are significantly informed by dataplor’s data. The overarching goal is to create a fully-automated AI system capable of assessing and pricing insurance risks, thereby streamlining the tasks of insurance underwriters. dataplor’s data, particularly information about businesses located within properties, plays a pivotal role in achieving this vision.

In conclusion, Tensorflight’s strategic partnership with dataplor has catalyzed remarkable advancements in the property insurance sector. With a commitment to data quality, accuracy, and innovation, Tensorflight is poised to transform the industry, making insurance underwriting more efficient and precise, thanks to dataplor’s invaluable contributions

You might also like:

Helping a Global CPG Brand Navigate Disruption and Grow Internationally How dataplor Transformed a Global Brand’s Market Insights How Yeme Tech Created a 15-minute Walkable Fulfillment Benchmarking Tool How Wolt Strengthened Their Selection Insights with dataplor Leveraging Location Data for Targeted Selection: How FLO® Utilizes dataplor’s POI Data to Enrich its EV Charging CoverageSubscribe to our blog and receive great content just like this delivered straight to your inbox.