Convenience at Scale: How dataplor and Linnda Unlock Mexico’s Retail Insights

In Mexico, convenience stores—known as tienditas de la esquina—are more than just quick stops. They’re essential hubs for groceries, bill payments, and community connections. These small-format retailers provide essential goods and services, especially in neighborhoods where supermarkets are scarce or expensive. With extended hours, local trust, and a deep understanding of their clientele, convenience stores have become an integral part of Mexico’s cultural and economic landscape.

For businesses trying to reach these essential retailers, visibility is key. That’s where the partnership between dataplor and Linnda comes in. By combining dataplor’s global location intelligence with Linnda’s intuitive platform, companies now have the tools to find, assess, and act on insights related to Mexico’s vast independent convenience store market.

Beyond the Chains: A Fragmented Landscape

When people think about convenience stores in Mexico, the first names that come to mind are OXXO and 7-Eleven. But beneath the surface of these high-profile brands lies a vast, fragmented ecosystem of independent retailers—and the numbers speak for themselves.

According to dataplor’s POI database, there are 179,755 convenience stores across Mexico. Surprisingly, 137,682 of them—over 76.6%—are independently owned and operated, not affiliated with any national or regional chain.

That means three out of every four convenience stores in Mexico fall under the radar of traditional data sources, which typically emphasize only major brands.

This fragmentation makes it difficult for brands, logistics providers, and retailers to truly understand market saturation, identify growth opportunities, or reach everyday consumers. Independent stores may not show up on search engines, location APIs, or basic mapping tools—making them invisible to many data platforms.

Why This Matters

- Consumer Access: Independent stores often serve as critical access points for groceries, prepaid mobile plans, and basic household goods in both urban and rural areas.

- Expansion Strategy: For businesses looking to expand product distribution or evaluate retail footprints, relying on chain data alone paints an incomplete picture.

- Data Visibility Gap: These “hidden” businesses and POIs are not just statistical blind spots—they’re missed opportunities.

That’s why dataplor’s approach to building and maintaining accurate POI data across all of Mexico’s municipalities, including remote, underserved, and informal areas, is a game-changer for companies that depend on accurate, real-world visibility into convenience stores and retail.

Analysis Results: Independent Stores Dominate Even in Metro Hubs

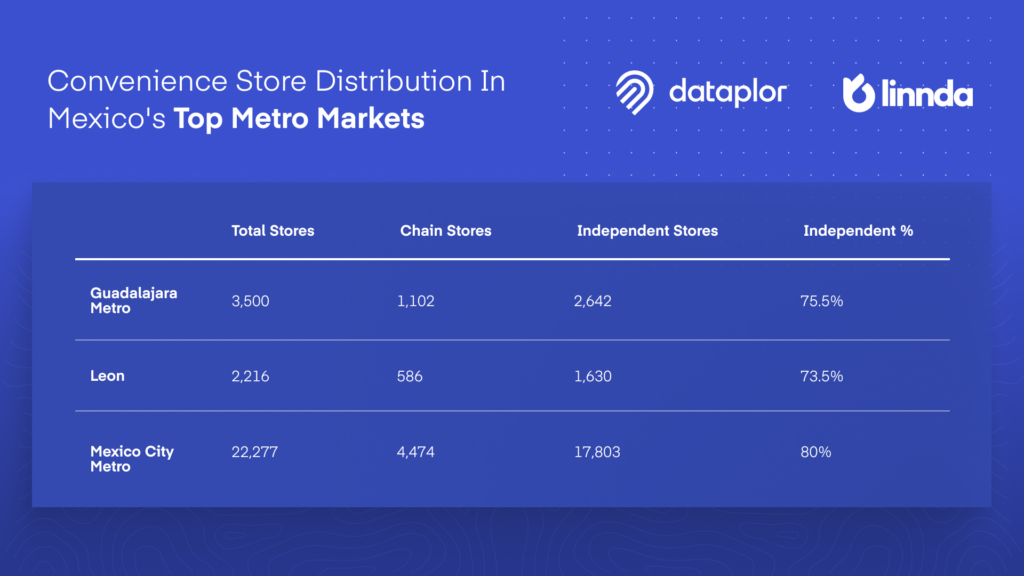

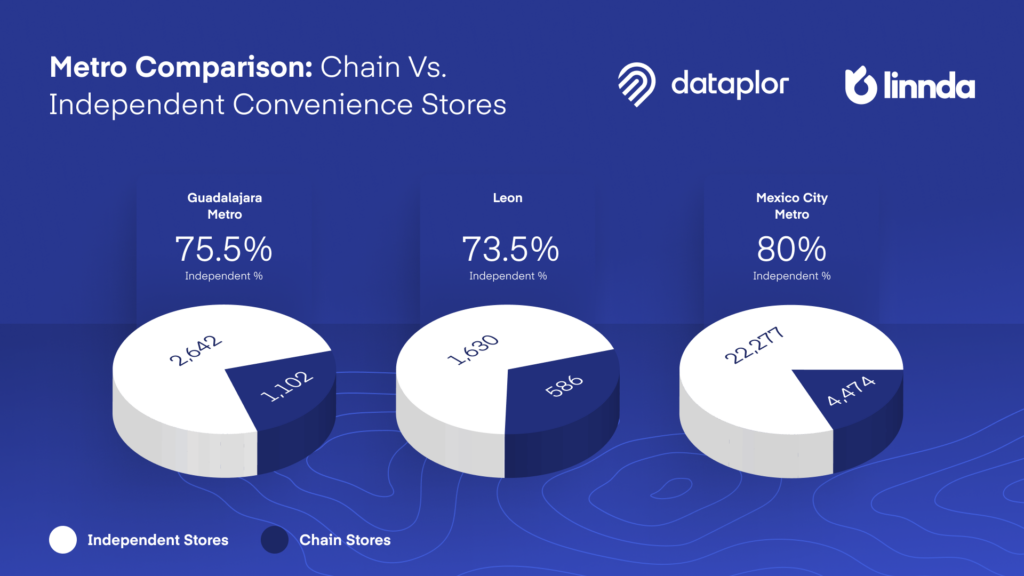

To demonstrate the depth of dataplor’s coverage, we conducted an in-depth analysis of convenience store distribution across several of Mexico’s largest metropolitan areas. The results confirmed a clear trend: independent convenience stores dominate the landscape, even in highly urbanized regions.

By leveraging dataplor’s robust location intelligence, we identified tens of thousands of active convenience stores across cities like Guadalajara, León, and the greater Mexico City metro area. Within each, a significant majority are independently owned and operated, reinforcing the importance of comprehensive POI coverage that extends beyond national chains. These findings not only underscore the depth and accuracy of dataplor’s dataset, but also highlight the critical need for visibility into the “hidden majority” of retail outlets that serve as vital economic and cultural hubs in their communities.

The Solution: dataplor + Linnda for Smarter CPG Distribution

As this analysis shows, even in Mexico’s most densely populated and economically dynamic metro areas, independent convenience stores far outnumber their chain counterparts. These small, often informal retailers are essential to the daily lives of millions, yet they remain largely invisible to conventional data providers.

That’s where dataplor makes the difference. With meticulously verified POI data spanning every municipality in Mexico, dataplor brings clarity to the fragmented retail landscape, unlocking insights that are critical for market expansion, competitive analysis, and strategic planning. In a country where over three-quarters of convenience stores are independently owned, having visibility into the full ecosystem isn’t just helpful—it’s essential.

Through our strategic partnership with Linnda, these insights are now more accessible and actionable than ever. Linnda’s powerful platform transforms dataplor’s verified location data into dynamic, easy-to-use insights that help CPG wholesalers, distributors, and field teams make smarter, faster decisions.

Whether it’s optimizing sales routes, identifying untapped independent stores, or pinpointing high-potential clusters by municipality, Linnda enables users to visualize and activate dataplor’s comprehensive dataset directly within their workflows. For companies selling into Mexico’s fragmented and hyperlocal retail ecosystem, this partnership eliminates guesswork and empowers precision.

With dataplor + Linnda, CPG teams can bridge the gap between store coverage and sales execution, expanding their footprint with confidence.

To learn more, contact us today at contact@dataplor.com or jose@linnda.co.