How the UK’s Top Grocery Chains are Evolving: Growth Stories from Aldi, Tesco, and Sainsbury’s

The UK grocery market has always been fiercely competitive, but over the past five years, the landscape has shifted in fascinating ways. Behind every new store, every closure, and every strategic move lies a story of adaptation, ambition, and long-term vision.

In today’s high-stakes retail environment, understanding where and how brands grow is essential. For investors, real estate developers, and portfolio managers, understanding these growth stories is more than an academic exercise—it’s critical to making smarter location-based decisions.

That’s why dataplor has partnered with Cherre, the leading real estate data management platform. By combining dataplor’s global location intelligence with Cherre’s real estate data integration capabilities, investment management and real estate firms can unlock powerful, location-based insights—especially for private chains that don’t share public disclosures. With Cherre, firms can easily combine dataplor’s point of interest data with a client’s internal portfolio data, and other third-party datasets to enable:

- Smarter site selection based on competitor proximity and retail growth patterns

- Visibility into openings, closures, and market shifts—especially from private chains like Aldi

- Custom investment models incorporating retail density, geospatial trends, and foot traffic insights

To illustrate how this works in practice, we analysed five years of store growth trends for three of the UK’s leading grocery brands: Aldi, Tesco, and Sainsbury’s. Instead of just counting stores, we looked at the why and where behind their expansion. The patterns reveal not only the strategies of these retailers, but also the opportunities they create for those looking to invest, build, or compete in these markets.

Aldi: The Challenger That’s Not Slowing Down

Few grocers have disrupted the UK market quite like Aldi. With a no-frills, value-first model, Aldi has shown consistent momentum with targeted bursts of expansion.

From 2020–2024, Aldi averaged a strong 4.9% annual growth rate in store openings. The brand kicked off the decade with 5.5% growth in 2020, followed by a peak of 6.4% in 2021. In 2022, the pace moderated to 4.7%, and 2023 saw a notable slowdown to just 0.8%, signaling a strategic pause. But in 2024, Aldi delivered an impressive 8.5% growth—its strongest performance in five years.

This cadence isn’t random. dataplor’s analysis suggests that the 2023 pause represented a deliberate period of site selection, planning, and operational optimisation. The result? A sharp rebound that underscored Aldi’s renewed confidence in capturing more market share.

Proximity Patterns: Retail Neighbors of New Aldi Locations

Our initial geospatial analysis highlighted Aldi’s 2023 slowdown and rapid acceleration into 2024. With dataplor’s location intelligence layered into Cherre’s platform, we were able to take the next step: examining the specific characteristics of Aldi’s 2024 store locations to uncover meaningful insights about their selection strategy. The goal was simple, to understand not just where Aldi is growing, but the underlying factors shaping those decisions.

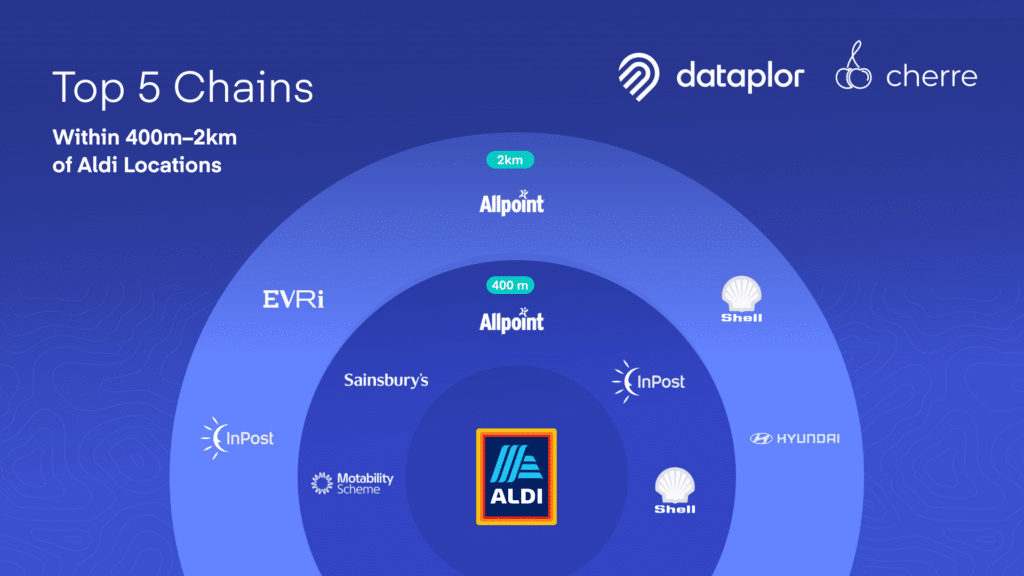

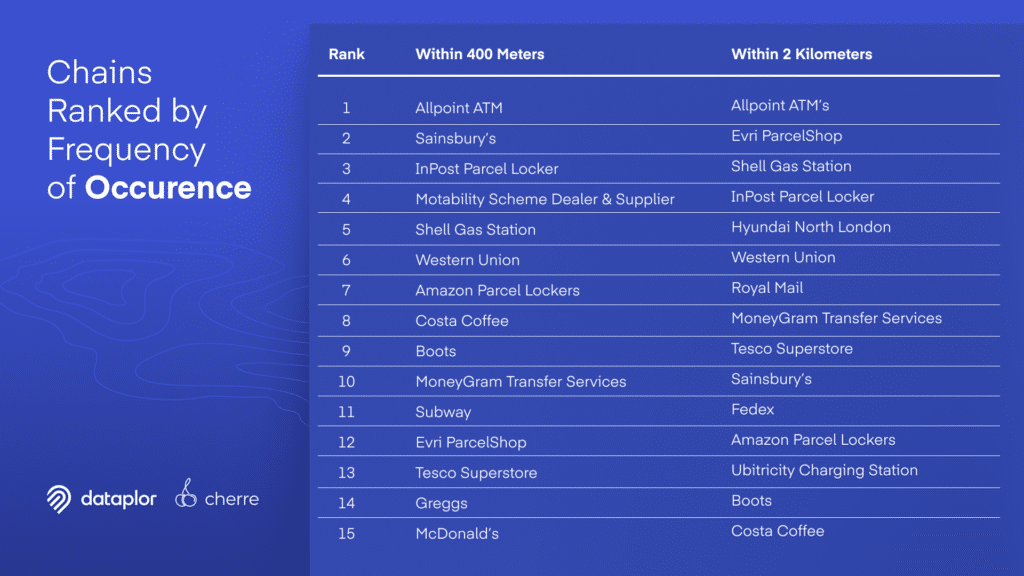

dataplor analysed the types of POIs and most common chains within 400m and 2km of the 80+ new Aldi locations that opened in 2024.

Interpretation:

- Allpoint and InPost: Aldi strongly favors utility-dense areas, ensuring customers have access to both cash and parcel services.

- Sainsbury’s presence supports the idea Aldi is not avoiding competition but rather positioning itself in established grocery zones.

- Motability Scheme proximity highlights a potential bias toward vehicle-accessible locations, perhaps in suburban commercial strips.

Chains Disproportionately Concentrated Near Aldi Stores

These chains appear almost exclusively within 400m and not in the wider 2km trade area, indicating Aldi may be deliberately co-locating near:

- InPost Lockers

- Motability Scheme Locations

- Evri ParcelShops

- Boots Pharmacy

- McDonald’s, KFC, Timpson (key service and fast-food chains)

Top 5 Most Common POI Types Within 400m:

- Bus Stops

- ATMs

- Beauty Salons

- Restaurants

- Corporate Offices

Strategic Implications

Aldi appears to be selecting new store locations with the following characteristics:

- High Accessibility: The presence of many bus stops suggests Aldi prioritizes locations with strong public transportation access, which can drive foot traffic and accessibility.

- Financial Convenience: Proximity to ATMs may indicate a preference for areas with available financial services, supporting quick cash access for customers.

- Community-Oriented Retail Zones: Beauty salons and restaurants point toward Aldi targeting areas that function as local commercial hubs with steady daily activity.

- Business Districts: The number of nearby corporate offices implies Aldi may be placing stores in or near employment centers, perhaps targeting lunchtime or post-work shopping traffic.

Tesco & Sainsbury’s: The Competitive Backdrop

While Aldi pushed aggressively into high-density commercial zones, Tesco and Sainsbury’s opted for more measured strategies over the same five-year period.

Tesco saw 3.6% growth in 2020, followed by 1.9% in 2021. Growth rebounded to 3.5% in 2022, then held steady through 2023 (3.2%) and 2024 (3.4%). dataplor’s insights revealed a trend of store closures during the later years of this period, highlighting a strategic reshuffling. Tesco appears to be fine-tuning its presence, prioritizing profitability and precision over rapid expansion.

Sainsbury’s, in contrast, followed the most conservative path. From 1.3% growth in 2020 to 2.8% in 2021, the brand dialed back slightly in 2022 (1.5%), rose again in 2023 (2.7%), and stayed consistent in 2024 (2.4%). These moderate, consistent figures reflect a company focused on stability, closing underperformers while reinforcing key strongholds.

Together, these approaches illustrate the broader market context Aldi is navigating and disrupting.

The Future of Growth is Data-Driven

The evolution of the UK grocery sector over the last five years is more than a story of new openings or market share battles—it’s a story of strategic intent.

dataplor’s location intelligence makes it possible to see beyond the headlines. We offer a detailed, dynamic view of store growth, site selection, market saturation, and competitive positioning in real time. With our integration into Cherre’s platform, it’s easier than ever for real estate and investment firms to put that intelligence into action.

Let’s explore what’s possible. Contact us to learn how dataplor and Cherre can help you unlock the full power of location intelligence—wherever your next move takes you.