Turn Global Location Data Into Confident Decisions

Location intelligence has become foundational to how organizations evaluate markets, allocate capital, and plan for growth. From expansion planning to risk assessment, understanding where activity happens in the real world increasingly shapes strategic decisions. Yet despite the volume of data available today, many teams still struggle to translate location data into clear, actionable insight.

The challenge is not access. It is usability, consistency, and global reliability.

Dataplor’s Global Platform was built to solve that problem. It gives teams a clearer, faster way to see where places are, and how people move through the physical world to understand market operations at global scale.

Why Location Intelligence Needs to Evolve

As companies expand into new regions and rely more heavily on location-driven data, existing tools often fall short.

- Global coverage breaks down outside major markets.

- Data quality varies by region and category.

- Analysis requires stitching together disconnected datasets.

- Insights take too long to synthesize to inform real-time decisions.

These gaps create uncertainty, and in competitive markets, uncertainty translates directly into missed opportunity.

Our platform brings accurate global places data and foot traffic insights into a single, intuitive experience designed for how teams actually work today. It replaces fragmented workflows with a unified view of markets that supports faster and more confident decision-making.

Built for Scale & Accessibility

Dataplor’s Global Platform is designed to be powerful without complexity .

Business, strategy, and analytics teams can explore data directly without writing queries or managing multiple tools. And importantly, underneath the hood our platform is backed by Dataplor’s continuously refreshed global dataset, consistent schema, and privacy-first approach to foot traffic data.

This combination ensures teams can trust the insights they’re drawing from the data, regardless of region and across diverse use cases.

A Visual Approach to Market Intelligence

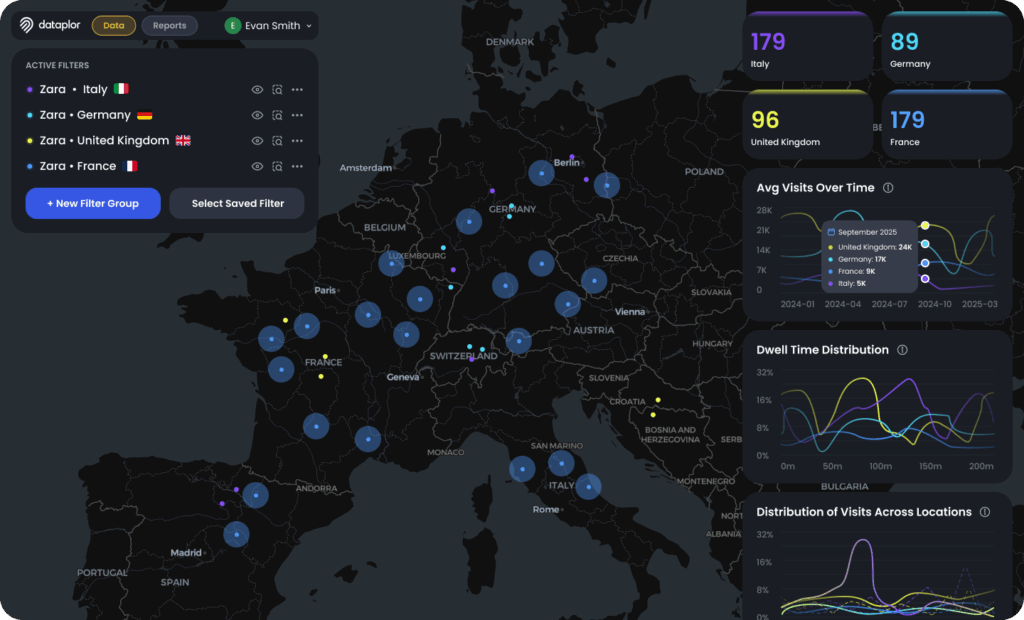

The platform centers on an interactive global map that allows users to explore markets visually, rather than through static tables or rigid dashboards.

Teams can move fluidly from a global view to regional comparisons and down to individual locations. They can analyze brand presence, category density, visitation trends, and market patterns without needing technical expertise or specialized tooling.

This visual approach matters because most location questions are exploratory by nature. The platform is designed to support investigation, comparison, and iteration, making it easier to uncover patterns, validate assumptions, and refine strategy.

How Leading Teams Use the Platform

The Platform is designed to support a wide range of industries and decision types. In practice, teams use it to answer questions like these:

Consumer Packaged Goods (CPG)

Where does our retail coverage actually exist, and where are we missing opportunities?

For CPG teams, distribution strategy depends on understanding where independent and regional retailers truly operate, especially outside large national chains.

The platform helps teams map retail presence across markets, identify whitespace where distribution is limited, and compare category density across cities and countries. This visibility allows teams to prioritize expansion based on real-world activity rather than incomplete or outdated lists.

Commercial Real Estate (CRE)

How do locations perform, and what signals indicate future growth?

Commercial real estate teams need to understand both where properties are located and how those locations function within their surrounding environment.

Using the platform, teams analyze tenant mix, foot traffic patterns around assets and corridors, and market dynamics across regions. This makes it easier to compare opportunities consistently and spot early signals of neighborhood change.

Financial Services

What is happening on the ground before it impacts operations and shows up in financial reporting?

For financial and investment teams, location data adds an important layer of real-world validation.

The platform allows teams to track physical expansion or contraction of brands, validate investment theses using inputs like visitation trends, and monitor activity in emerging or underreported markets. These insights help ground financial analysis in observable market behavior.

A Clearer View of the World

Markets are constantly changing. Stores open and close. Consumer behavior shifts. And new opportunities emerge faster than traditional data sources can capture.

Our platform helps teams see those changes sooner, understand them more clearly, and act with confidence.

By turning global complexity into an intuitive visual experience, the platform enables better questions, faster insight, and stronger decisions.